Understanding How Insurance Quotes Are Calculated

Introduction and Outline: Why Quotes Vary and How to Read Them

Insurance quotes can feel like puzzles with pieces from different boxes: a little bit of your personal profile, a lot of coverage decisions, and a layer of risk analysis you rarely see. Yet the logic is surprisingly orderly once you know where to look. Insurers estimate the expected cost of claims (frequency multiplied by severity), add operating expenses and taxes, include a margin for uncertainty, and then apply adjustments based on your coverage choices and risk characteristics. That’s the short version. The long version—what you came for—shows how coverage, premiums, and underwriting work together to turn data into a dollar figure.

This article is designed for clarity and practical use. We begin with an outline so you can scan what matters most and jump to the sections that help you make smarter decisions. You’ll find explanations, small numeric examples, and suggestions you can use immediately when comparing quotes. The goal is to translate industry language into plain steps you can act on without oversimplifying how risk is priced.

What we’ll cover:

– Coverage: How limits, deductibles, and add-ons shape both protection and price.

– Premiums: The arithmetic behind your quote, including rating factors and expense loads.

– Underwriting: The rules and data that sort risks into pricing tiers or eligibility buckets.

– Putting it together: A practical playbook for getting accurate, comparable quotes and adjusting them intelligently.

Why this matters now: price sensitivity is high, and risk patterns shift with weather trends, construction costs, medical inflation, and driving behavior. Even small choices—raising a deductible, adjusting a liability limit, adding a safety feature—can move your premium more than you might expect. If you understand the levers, you can decide which ones to pull and when. By the end, you’ll be able to read a quote like a map: not just where you are, but how to get where you want to go with fewer surprises.

Coverage: Limits, Deductibles, Exclusions, and Add‑Ons

Coverage is the contract of what is paid, for which perils, and up to what amount. It sets the boundaries of your financial protection and is the first major driver of price. Think of limits as the ceiling, deductibles as the floor you agree to handle, and exclusions as the walls that shape the room. Adjust any of these and your quote shifts, sometimes modestly, sometimes significantly.

Limits determine the maximum the policy will pay. For liability coverages, higher limits reduce the chance you’ll run out of protection in a large claim, but they usually raise your premium. For property coverages, limits should reflect replacement or repair costs, not sentimental value. If a home’s estimated rebuild cost is $350,000, setting a dwelling limit at $250,000 might save premium but could leave a six-figure gap if a major loss occurs. Conversely, overinsuring beyond realistic costs wastes money without adding value.

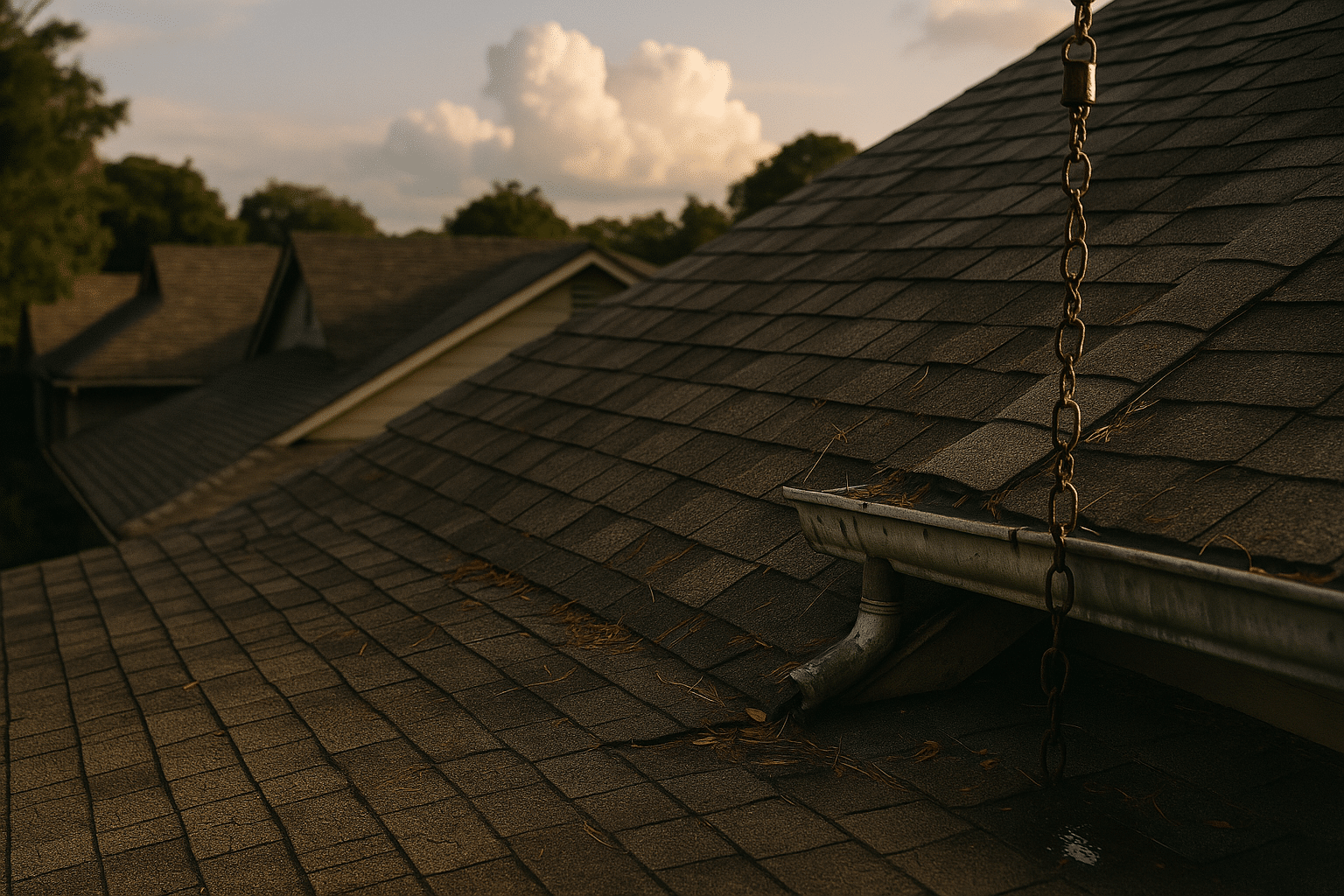

Deductibles are the amount you pay before coverage kicks in. A higher deductible typically lowers your premium because you’re absorbing more small losses. For example, moving a deductible from $500 to $1,000 may trim a homeowner’s premium by several percentage points, depending on the market and claim history. The trade-off is cash flow risk—make sure the chosen deductible is an amount you can comfortably pay without disrupting essential expenses.

Exclusions clarify what is not covered. Common exclusions might include wear and tear, maintenance issues, certain catastrophic events unless specifically endorsed, or business use in a personal policy context. Reading exclusions can feel tedious, but they are where misunderstandings often hide. If a peril matters to you—say, sewer backup, equipment breakdown, or certain natural hazards—check whether an endorsement exists to add it. Add‑ons (often called riders or optional coverages) can tailor a policy to your situation: extended replacement cost, ordinance or law coverage, rental reimbursement, or scheduled personal property for higher‑value items.

Practical comparisons help:

– Scenario A: Moderate limits, low deductible, few add‑ons. Premium is higher due to frequent small-claim exposure.

– Scenario B: Higher limits, higher deductible, targeted add‑ons. Premium may be similar to Scenario A, but risk is shifted to fewer, larger claims and protection for specific perils is stronger.

– Scenario C: Lower limits, high deductible, no add‑ons. Premium is lower, but out‑of‑pocket risk and coverage gaps rise substantially.

Coverage is not about spending more; it’s about aligning the policy with your risk tolerance and financial goals. The right combination depends on your assets, income stability, local hazards, and how much volatility you can shoulder.

Premiums: From Loss Costs to Your Price Tag

Premiums are built from a few core components: expected losses, expenses, and a margin for uncertainty. Expected losses reflect how often claims happen (frequency) and how costly they are (severity), derived from historical data adjusted for trends. Expense loads include agent compensation, customer service, regulatory fees, and general overhead. The margin (sometimes called contingency or target underwriting profit) accounts for randomness—bad luck can cluster, and models are never perfect.

Rating factors translate your profile into numbers. Common examples include location (exposure to theft, storms, wildfire), construction characteristics (roof age, materials), driving or claim history, usage patterns (annual miles, occupancy), safety features, and where allowed, credit‑based insurance attributes. Each factor adjusts the base rate up or down. In practice, pricing involves multiplicative and additive elements and may vary by state due to regulation and filed rating plans.

Here is a simple illustration to show the mechanics (not a quote): Suppose the base annual rate for a certain risk class is 600. Territory factor is 1.15 due to higher local claim costs. A roof age factor of 1.10 applies, while a protective device factor of 0.95 applies. Deductible selection reduces by 0.90. Expenses and margin combine to add 120 flat. The rough premium estimate becomes: 600 × 1.15 × 1.10 × 0.95 × 0.90 + 120 ≈ 732. Adjust any factor—say, installing additional safety features that bring the 0.95 to 0.90—and the math responds in kind.

Discounts and surcharges matter, but context is key. A discount for bundling policies, for example, may be offset by higher base rates if one line of coverage has elevated loss trends in your area. Safer choices—impact‑resistant roofing, telematics participation, water leak sensors—can reduce frequency or severity, and some carriers reflect that in pricing. Conversely, recent losses, high‑risk usage patterns, or major construction concerns can lead to surcharges.

What increases are we seeing lately? Construction materials and labor have pushed property claim severity upward in many regions, while certain areas face more frequent severe weather. In auto lines, parts complexity and repair times can elevate costs. These trends feed into rates gradually, which is why premiums may rise even if you haven’t filed a claim. Understanding the arithmetic helps you see which levers you can control—and which you can only plan around.

Underwriting: Risk Selection, Data, and Fairness

Underwriting is the gatekeeper of both eligibility and price. It assesses the likelihood of a loss and how costly it could be, placing applicants into tiers or deciding that a risk doesn’t fit certain guidelines. Some underwriting is automated through scoring models; some remains manual, especially for complex properties, unique exposures, or borderline cases. The objective is consistency and solvency: pooling similar risks together so that premiums remain sufficient and fair across policyholders.

What data informs underwriting? For property, key inputs include roof age and condition, electrical and plumbing updates, distance to fire services, local fire protection resources, and catastrophe exposure such as wind, hail, wildfire, or flood. For vehicles, common considerations include driving history, annual mileage, vehicle age and safety features, and garaging location. Prior loss history is typically reviewed through industry loss‑reporting sources, and, where permitted, credit‑based insurance attributes may influence tiering. Insurers also reference external hazard maps, building code updates, and inflation indices for materials and labor.

Underwriting guidelines are shaped by regulation. Some rating factors are restricted or prohibited in certain jurisdictions, and any scoring method must be filed or otherwise compliant. This is why a clean driver may still see varied quotes across companies—each organization weighs risk variables differently within regulatory boundaries. Appeals or exceptions sometimes occur when new information emerges, such as updated home inspections or verified safety upgrades.

Two forces are always in tension: adverse selection and affordability. If pricing is too lenient for high‑risk profiles, losses concentrate and force rate hikes on everyone. If pricing is too strict, some lower‑risk applicants subsidize others or leave the pool. Underwriting aims to thread this needle by refining data, encouraging risk‑reducing improvements, and aligning coverage terms with the applicant’s actual exposure.

Practical takeaways:

– Document improvements: roof replacements, water shut‑off valves, security systems.

– Verify data: square footage, occupancy, mileage, driver assignments, and garaging address.

– Ask about inspections: a short visit can adjust assumptions on condition or hazards.

– Understand re‑rating triggers: renovations, household changes, or claim activity can prompt review.

When you see an underwriting note or requirement, it isn’t arbitrary—it’s the mechanism that keeps coverage sustainable while tailoring price to true risk.

Putting It All Together: A Playbook for Smarter Quotes

Now that you’ve seen how coverage, premiums, and underwriting intersect, it’s time to turn the insight into action. The goal isn’t to chase the lowest number at any moment; it’s to secure reliable protection at a price that matches your risk profile and financial comfort. That means organizing your information, making comparable choices across carriers, and refining the variables you can control.

Start with preparation. Gather details on property systems and updates (roof, electrical, plumbing, heating), safety features, distances to fire services, and any recent improvements. For vehicles, compile VINs, current mileage, commute patterns, and driver history. Decide in advance on target limits and deductibles so you’re comparing like with like. If you quote different deductibles or liability limits across carriers, you’ll never know which price is truly more efficient for the protection provided.

Build an apples‑to‑apples comparison:

– Choose two or three coverage configurations you could live with (for example, higher limit/higher deductible vs. moderate limit/moderate deductible).

– Request quotes using the same configurations from multiple carriers.

– Record any underwriting notes or requirements that might add cost or effort (inspections, mitigation steps).

– Note discounts contingent on behavior (telematics participation, water sensors) and decide whether they fit your lifestyle.

Look for leverage points. Could a roof upgrade or water‑leak sensor reduce both risk and premium over time? Would a higher deductible meaningfully cut price without straining your emergency fund? Are there optional coverages that plug outsized financial gaps at modest cost (ordinance or law coverage for older homes, or rental reimbursement if you depend on a single vehicle)? Match mitigations to exposures you actually face rather than adding features you’re unlikely to use.

Finally, review annually or after life changes. Household composition, major purchases, renovations, or shifts in commute can alter your profile. Revisit limits as rebuilding and medical costs evolve. If a quote jumps, ask why: a shift in territory rates, a recorded loss, or new assumptions about your property might be at play. Clarifying data and highlighting improvements can sometimes move you to a more favorable tier.

Conclusion for policy shoppers: Invest a little time upfront to set coverage targets, verify data, and compare cleanly. You’ll reduce surprises, uncover realistic ways to lower cost, and make underwriting work with you by presenting a clear, accurate picture of your risk. In a market where conditions change, that steady process is your most dependable advantage.